Starting a business in India is exciting, but choosing the right business structure is what sets up your startup for success in the long run. From tax obligations and legal liabilities to operational control and growth prospects, everything depends on the business structure you choose. Here’s a broad outline to get you started with understanding different types of business structures in India and determining which one best suits your startup.

Why Business Structure Matters

When you start a new business, the structure determines liabilities, taxes, registration processes, compliance requirements, and even how easy it would be to raise capital. Let’s have a deeper look into each of the types of business structures in India and see how that would shape the growth and operation of your startup.

Familiarity with Business Structure Types in India

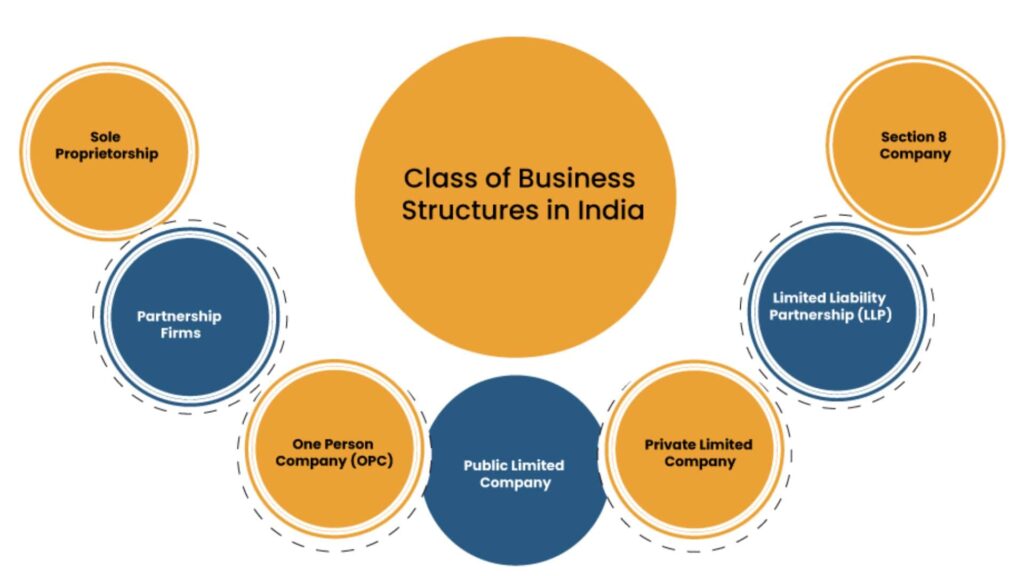

India comes along with multiple types of business structures, each having unique features. However, some of the most common types include;

Sole Proprietorship: The type is owned and operated by one individual. It is as simple as this, suitable for small businesses or a single entrepreneur. Being a sole proprietorship entails that the owner is personally liable for business debt or legal obligations even when it is easy to establish the business.

Partnership Firm: Partnership Firm Two or more persons can form a partnership. They share in ownership, responsibility, and profit. The partnership may be registered or unregistered. Legitimized protection comes with registered partnerships. In a partnership, all partners are jointly liable.

Limited Liability Partnership (LLP): A partnership, and at the same time, a corporation: it has attributes of a partnership and a corporation. There is limited liability towards its partners because personal assets are saved from business risks. It is a popular structure for professional service firms.

Private Limited Company (Pvt. Ltd.): Private Limited Company-Appropriate format for start-up ventures that will raise investment; the liability of a firm is limited, and technically different from its owners; businesses are under strict regulations and relatively cumbersome to set up and operate.

One Person Company (OPC): Hybrids of a sole proprietorship and a private limited company, OPC offers the ownership of a business with limited liability to a single person. It is appropriate for individual entrepreneurs who wish to limit their risk.

Public Limited Company: It is designed for companies that want to raise share capital from the public, and for them a Public Limited Company involves strict adherence to rules and is more challenging to operate.

Choosing the Most Suitable Business Structure in India

The type of structure you want will be determined by several critical factors:

Legal Liability: You want to know how much personal liability you would accept. LLCs and Pvt. Ltd. types of structures have limited liability while sole proprietorship and partnership have no liability protection.

Capital Requirements: If you need to raise capital from investors, then Pvt. Ltd or a Public Limited Company may be more suitable as it facilitates external funding.

Control and Management: Control that one can choose while coming up with the company. A sole proprietorship allows all control, whereas in an LLP or a partnership, management is shared. Pvt. Ltd. companies have shareholders, so decisions get complicated with shareholdings.

Tax Implications: Tax rates will vary with the form. For example, income earned by Pvt. Ltd. companies is taxed based on corporate tax rates, while income earned by sole proprietorship is liable to income tax on the profits.

Registration Complexity and Compliance: Sole proprietorship is a relatively simple creation, whereas Pvt. Ltd. and Public Limited Companies have to follow very detailed regulatory compliance procedures.

LLC vs. Sole Proprietorship in India

Many entrepreneurs cut it down to an LLC or a Sole Proprietorship. Here’s how they stack against each other.

| Factor | Sole Proprietorship | LLC |

| Liability | Unlimited personal liability | Limited liability for owners |

| Control | Full control by the owner | Shared control among members |

| Taxation | Income tax on profits | Corporate tax rate on profits |

| Ease of Setup | Simple registration | More formal and requires more paperwork |

| Funding | Harder to raise external funds | Easier to attract investors |

How to Select a Business Structure in India: Step-by-Step Guide

If you can’t still decide, here’s what you do:

Evaluate Your Goals: You know what you want to accomplish in the long run. Do you want to keep it small or eventually go public?

Consider Your Budget: Setup and compliance costs differ. The sole proprietorship is quite economical, whereas the Pvt. Ltd. companies demand higher operational costs.

Think About Legal Liabilities: For high-risk industries, limited liability would be advisable.

Review Tax Requirements: Research on tax rates and obligations differ as per the structure.

Consult a Professional: Meeting with a business consultant or attorney usually proves helpful.

Registration of Business Structure in India

Online options have made the Company Registration procedure in Mumbai and other cities easy. Here is a step-by-step process guide for registration:

Sole Proprietorship: Get registered at the local municipality and obtain necessary licenses as appropriate.

Partnership: Draft a partnership deed and get the same registered with the Registrar of Firms.

LLP: Registration on MCA portal and LLP agreement.

Pvt. Ltd. And Public Ltd: Registration on MCA portal and Digital Signature Certificate and Director Identification Number.

Conclusion

Choosing the right business structure is one of the most important decisions that will profile the future of your startup. This, hence, has to be considered on financial grounds, preference for control or preference in liability, tax implications, and so on. Remember, scalability structures ease transitions as your business grows.